Twitter \ MEDI-K.O. على تويتر: "Per-Unit Tax Graphs, Points, & Areas You Must Know - Buyer's Share of Tax vs. Seller's Share of Tax #apmicroeconomics http://t.co/hRMvg76kMy"

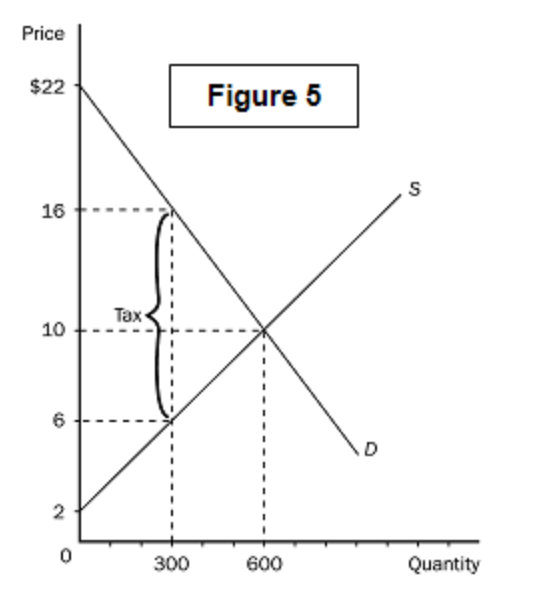

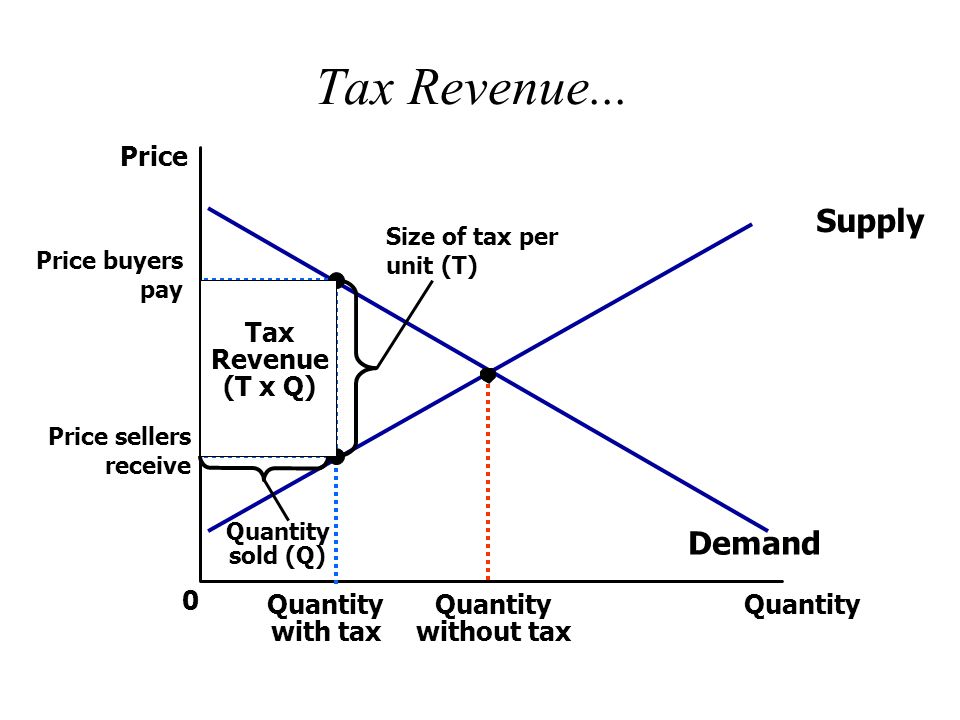

The following graph shows a market in which tax of $10.00 per unit is imposed. Calculate the value of consumer surplus before tax. | Homework.Study.com

What is the per-unit burden of the tax on the sellers? a. $6 b. $8 c. $14 d. $16 | Homework.Study.com